BRSA: Banks to calculate the net stable funding rate

According to the regulation published in the Official Gazette, banks will start calculating the net stable funding rate in order not to deteriorate their liquidity levels due to funding risk. According to this;

-The rule is effective from 1 January 2024.

-Turkey's banking watchdog, the BRSA, is authorized to determine the procedures and principles regarding the calculation of the ratio.

-The simple average of 3-month consolidated and unconsolidated net stable funding rates will not fall below 100%.

Especially after the 2008 financial crisis, banks' liquidity buffers gained more importance. In this context, similar to the NSFR (Net Stable Funding Ratio) calculation announced in the Official Gazette yesterday, LCR (Liquidity Coverage Ratio) was followed in our country and in the global banking system in terms of showing that the banks had sufficient liquidity.

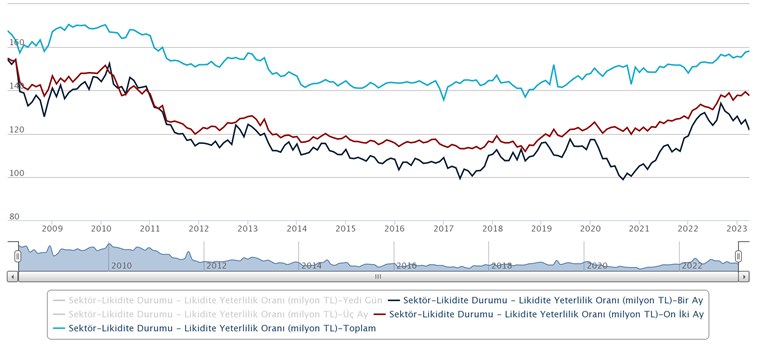

Banking Sector Liquidity Adequacy Ratios… Source: BRSA, Dinamik Yatırım

The LCR is the percentage of the bank's stock of high quality assets divided by the estimated total net cash outflows over the 30 calendar day stress scenario. The NSFR presents the ratio of long-term assets financed by stable funding and is calculated by dividing the amount of Available Stable Funding (ASF) by the amount of Required Stable Funding (RSF) over the one-year horizon. These rates are required to be above 100%. The difference is whether the LCR 1-month liquidity is sufficient and the NSFR 1-year liquidity is sufficient.

The LCR is currently over 150% for the overall banking industry. It is not a regulation that will impose additional obligations on banks. It should be evaluated positively in order to follow liquidity buffers more securely.

Kaynak Dinamik Yatırım-Enver Erkan

Hibya Haber Ajansı