Fed: Powell says higher interest rates are needed to curb inflation

Fed Chairman Jerome Powell said policymakers expect interest rates will need to move higher to keep US growth below its long-term trend and limit price pressures, with the timing of additional increases based on incoming data. "My colleagues and I understand the challenge posed by hyperinflation and are strongly committed to bringing inflation back to our 2 percent target," Powell told the House Financial Services Committee: “We will continue to make our decisions in meetings according to the risk balance."

If we look at the highlights of Powell's statements;

-Nearly all FOMC participants think it would be appropriate to raise interest rates a little more by the end of the year.

-Reducing inflation will likely require a period of below-trend growth and some softening in labor market conditions.

-When determining the extent of additional policy tightening that may be appropriate to return inflation to 2% over time, we will consider the cumulative tightening of monetary policy, delays in monetary policy's impact on economic activity and inflation, and the economic and financial situation.

-The 12-month core PCE (Personal Consumption Expenditure) is 4.7% and the core CPI (Consumer Price Index) is 5.3%, well above the 2% target. However, Powell emphasizes that inflation expectations are anchored, showing that people predict inflation will be temporary.

-Powell described the labor market as "very tight" despite the unemployment rate rising to 3.7% in May: “There are some signs of a better balance of supply and demand in the labor market”. Powell states that an average of 314,000 jobs were created per month in the first five months of the year.

-Powell states that wages are showing signs of normalization, but demand for labor is still higher compared to market supply.

-Powell referred to the Fed's definition of tighter U.S. credit conditions in the wake of bank failures in March in his semi-annual report to Congress on Friday: “For households and businesses that are likely to put pressure on the economy, economic activity, hiring and inflation. facing headwinds from tighter credit conditions. The extent of these effects remains unclear.”

-Powell ends by discussing the bank crisis. He explains that his decision to skip a rate hike in June was driven by the need to assess the impact of previous hikes rather than the crisis itself.

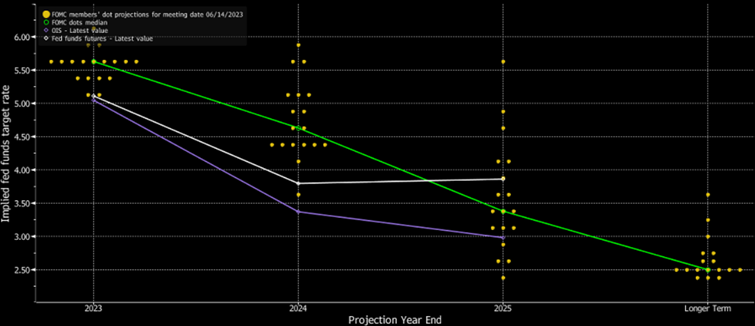

Fed's New Dot Plot… Source: Federal Reserve, Bloomberg

In summary, Powell largely reiterated his remarks at the post-meeting press conference last week, where he said the committee thought it appropriate to slow the pace of rate hikes in the wake of the most aggressive increase in four decades, as well as recent bank bankruptcies that could tighten. The highlights in Powell's Capitol Hill speech and the FOMC reflections he reflected raise the possibility of two more quarter-point increases for the remainder of the year.

The FOMC stopped a series of rate hikes for the first time in 15 months last week, leaving rates in the 5% to 5.25% range. But Fed officials predict rates will rise to 5.6% by the end of the year, according to median estimates, which means two additional quarter-point gains after surprisingly persistent inflation and labor market strength. Fed officials are targeting a below-trend growth period to ease price pressures. The FOMC raised its outlook on economic growth and the labor market for 2023 last week, but now expects unemployment to rise to 4.5% next year.

Kaynak: Dinamik Menkul- Enver Erkan

Hibya Haber Ajansı