CBRT: Bond purchase rule eases in card withdrawals

According to the news of Bloomberg HT, the Central Bank is loosening the new rule that obliges banks to buy government bonds for customers to withdraw cash from credit cards, overdraft accounts and gold spending. According to this;

-According to the amendment, expenditures up to 15,000 lira ($758) will be exempted from the bond purchase obligation.

-The regulation required customers to purchase government bonds equal to 30 percent of their gold and jewelery purchases with credit cards with a monthly spending limit of more than TL 50,000.

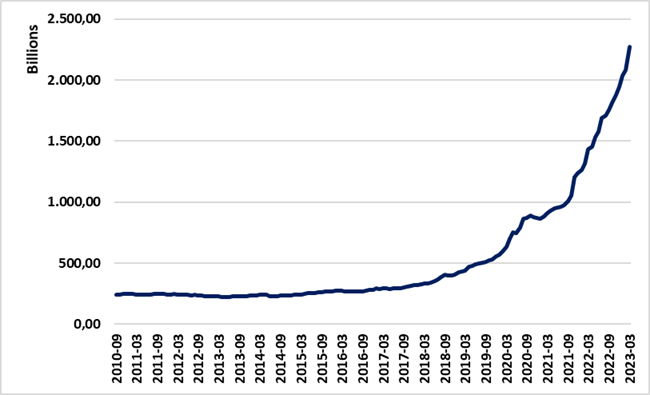

Monthly, Securities, Banking Sector (Thousand TL) (Monthly)… Source: CBRT, BRSA, Dinamik Yatırım

While the CBRT is implementing macroprudential measures and rules that are thought to be temporary to prevent foreign exchange speculation, it seems that it has tried to loosen the previous regulation a bit and to ensure that credit and cash usage opportunities are within the scope of necessity. Such opportunities, which are used with loan rates under inflation, can go to foreign currency or gold in the environment of election uncertainty. The securities establishment rule, on the other hand, limits this type of speculative demand.

In the inflationary environment, while loan rates remained low due to regulations, deposit rates seem to have exceeded loan rates. Obligation to buy long-term fixed income bonds may cause maturity mismatch and price risks in the balance sheet.

Kaynak Enver Erkan / Dinamik Yatırım

Hibya Haber Ajansı